Author Note: This is the third article in the series “A Financial Carol” – Reference the first two in the series – “A Financial Carol – Past, Present, and Business Yet to Come” and “A Financial Carol Chapter 1 – The Right General Ledger: Revenue”

We are now ready to take a look at how expenses are recorded in your GL chart of accounts. Some of the discussion below may reference the prior discussion on the GL revenue accounts, so you may find it helpful to review those materials.

Organizing Expense Accounts

Deciding how to organize your expenses in the chart of accounts is going to first require a clear understanding of Direct vs. Indirect expenses and will then center on three specific decision points:

- Are you tracking cost of goods sold (Direct Expenses)?

- How granular do you want to be in tracking labor against specific tasks in your business (Direct vs. Indirect Expenses)?

- How granular do you need to, or want to track operational expenses (Indirect Expenses)?

A default GL chart of accounts (like one you might find in popular accounting software) will offer two distinct “types” of expenses. This follows best standards set forth by Generally Accepted Accounting Practices, or GAAP (GAAP standards exist to create uniform accounting methodologies that enable proper valuation and comparison of businesses for investors, owners, etc.).

Disclaimer

This series is about financial reporting and how you as a CEO can create financial reports that enhance your ability to lead your business effectively. You should consult a certified accounting professional and/or tax attorney to ensure that your accounting aligns with the Generally Accepted Accounting Principles (GAAP) standards and that you are correctly identifying, recording, and reporting all financial transactions and totals for tax purposes.

COGS/COS – Direct Expenses

You will find GL accounts available, and create GL accounts, that are categorized as COGS (Cost of Goods Sold) or COS (Cost of Services). Expenses recorded in these accounts should be expenses that are directly related to the creation (e.g., manufacturing, content creation, consulting content, training content) and delivery (e.g., shipping, direct employee labor or contractor (non-employee) labor, venue rental, courier service) of your products and/or services.

Creating the storyline relationship between your product and/or services sales and the direct expenses for creating and delivering the products and/or services is vital to making good decisions. This relationship allows you to read stories about pricing, trends in costs of goods (whether manufacturing or purchases of goods), accuracy of service quotes, and margins of finished goods and/or services. I cannot emphasize enough how important it is to have full and accurate visibility into your direct costs.

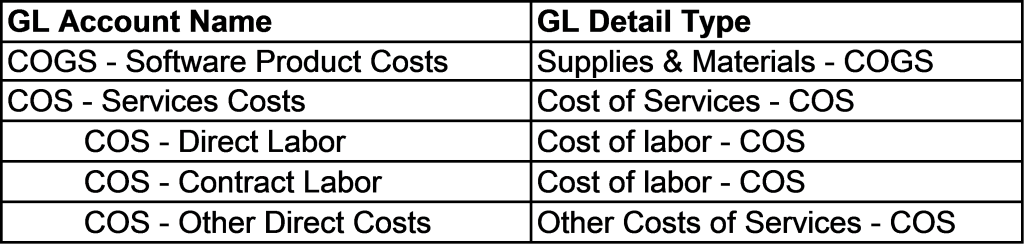

Sample Direct Expenses

Based on the sample Software Sales & Service company used in the prior post on GL Revenue, below would be the proposed DIRECT expense accounts:

Using these GL accounts and properly recording transactions into the correct accounts, this CEO/business owner can access views and reports to track the following different storylines:

- The storyline of the cost of software products sold total on any Profit & Loss reports or other reporting of income.

- The storyline of the overall cost of services (all sub-accounts will total) as well as detailed stories of cost of employee and contract service labor and other related service costs.

Significance of Direct Expenses

You might have noticed that in the Revenues chart of accounts, there were three Software Sales sub-accounts for Package 1, Package 2, and Package 2). Yet, I am suggesting only one COGS account for recording all of the software sales costs. Why?

That leads the discussion to the bigger “why” – why record direct costs at all?

The purpose of recording direct costs separately from indirect costs (discussed below) is to isolate the cost directly related to providing a product or service. This reveals your Gross Margin for your products and/or services. The Gross Margin can be represented as the actual number

Revenue of the Product or Service – the Cost of the Product or Service = Gross Margin

or as a Gross Margin Percentage

Cost of Product or Service/Revenue of the Product or Service = Gross Margin Percentage

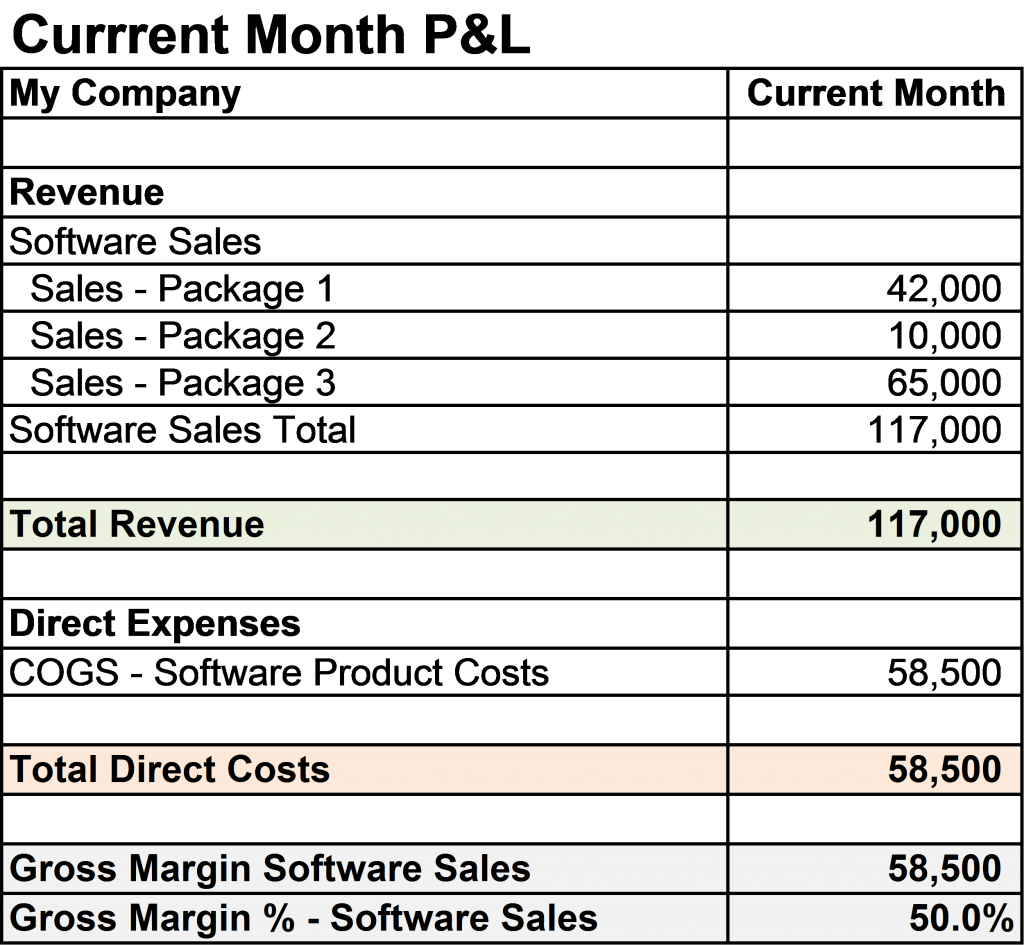

Using our example of Software Sales, let’s say that software sales totals were:

and the Cost of Goods Sold for software sales were:

You can then create financial report calculations for Gross Margin and Gross Margin Percentage that would appear something like the following snippet:

The gross margin on software sales is 50% of the sales revenues. The reason only one COGS GL account is needed in this case is that every software product sold has the same gross margin (example of reselling third-party software where by contract you pay them 50%). You have three lines of revenue reporting so you can determine the progress of sales on each specific software package, but since you know that all packages have a 50% margin, there is only need for one line of recording the direct costs.

That provides a very simple example to introduce a few basic direct cost guidelines:

- If you sell products and these products are produced (or purchased) using the same process (manufacturing) or from the same type of source (margin consistent because of purchase contract) – then one COGS GL account should be sufficient.

- If you sell products where the gross margin may be significantly different – manufactured differently, produced from sources of varying margins, distributed in completely different ways (channels), you will likely want to use sub-accounts that tie directly back to the proper revenue sub-accounts.

- If you sell services, then you should at a minimum have one COS – Services account to record direct expenses associated with providing that service. This is where many services companies fail to put in the work and leave CEOs with no view of their true Gross Margin on services. This makes pricing evaluation difficult at best, and provides no story on how the services group performs against contracts signed.

- If you sell more than one type of service and you want to see those storylines separately (they are unique types of services with different margin potentials), then use the method described in (2) above to create sub-accounts for services.

Service Labor and Direct Expenses

When you start recording labor directly associated with the delivery of a service, you will find is straightforward to record “contract” labor that is hired (e.g., trainer to deliver training, programmer to write code, web designer to design a new web site) specifically for those tasks. Where you will struggle is deciding when and how to record employee labor as direct expenses.

Here are a few guidelines that may help:

- Employee salaries are normally recorded in the Indirect Expense area of the general ledger in payroll accounts. That is important in tracking overall payroll activity consistently.

- If you want to record a portion or all of an employee’s labor cost as a direct expense, you would likely use an “allocation” method where each month you review the hours spent working as a direct cost and manually credit/debit the proper accounts to move those costs to the correct “direct” expense account.

- Given that this is for reporting/analysis only, you can use an average allocation if you believe this is accurate enough.

The goal is for your financial reports to tell the most accurate story possible in terms of the true “cost” of a product or service. If employee labor is a significant part of those costs, then it is more important to get that right. If employee labor is a minor part of the costs, this may not be worth the trouble. There will be more on this as we cover the story of pricing and profitability later in the series.

The Power of Gross Margin Calculations for Services

For companies that provide services, correctly aligning service revenues with direct expenses creates a gold mine of information (powerful story line) for leadership. In some businesses, all services are billed very exactly by calculating some factor of the actual hours worked at a specific rate/hour.

Let’s say that a legal firm can attribute every hour worked for a client to one or more individuals at specific rates/hour. They know they bill those clients at a factor of say 2x, so the revenue for that work is exactly 2x the cost of delivering that project. They may also add in other expenses (e.g. copies/paper, filings) and bill the client at 2x the cost for those non-labor expenses. In a perfect world, they would not need to look at their gross margins because the percentage would always be the same (50%).

The truth is that the services industry as a whole does not operate this cleanly and is very susceptible to inaccurate pricing/quoting, scope creep that increases the actual work delivered on a project, and other factors that require careful examination of both the gross margins of the overall revenue, but likely some type of analysis of margins by project.

On top of that, there is the issue of “bench” time or non-billable time and overheads in your services business. All of these overheads (which would then be recorded in the Indirect Expenses) are the drag on real profits in the services business and must be examined and carefully managed as part of the story line.

I will examine the services business story line in much greater detail later in this series.

Do You and Should You Track Direct Expenses?

It is my view that it is very rare that any business would not track direct expenses. Any business that sells products manufactured or purchased should definitely, and likely is, recording and reporting on direct expenses and gross margins. This is a practice that has a longer history as a best practice in the manufacturing industry quite simply because of the direct relationship to pricing and pricing decisions.

As the services industry has evolved, a much lower percentage of those businesses track direct expenses. It is more likely that a service business puts all expenses into the same category (just general expenses). If those businesses do any analysis of service margins, it is likely in spreadsheets or in other project-oriented software. For those that do, great! However, that storyline is buried. The best practice would be that all create the ability to record and report their direct costs and gross margins in the financials to create more visibility within the overall financial performance of the company.

My answer to the question above is “yes.” Yes, you should invest the time and energy to create the structure and processes to accurately record and report any direct expenses associated with the products and/or services you sell. As we will demonstrate in the series posts that follow, the storyline that this creates for any leader is much too rich to sacrifice.